Gm music fans,

Back in December, music NFTs were hitting several record highs with instant sellouts every day.

But you might have felt things slow down in January and February.

Primary sales, secondary sales and number of drops have all fallen slightly from December’s festive highs.

There’s a reason for that… and it’s partly due to the broader crypto cycle.

Let’s enjoy some chart p*rn.

Part 1. Where are we in the crypto cycle?

Crypto cycles have a huge influence on NFT sales.

If you’re buying or selling NFTs you need to know where we are in the cycle.

How crypto cycles impact NFTs

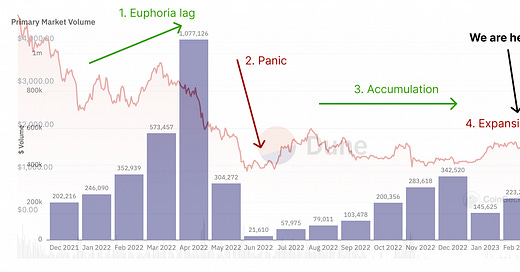

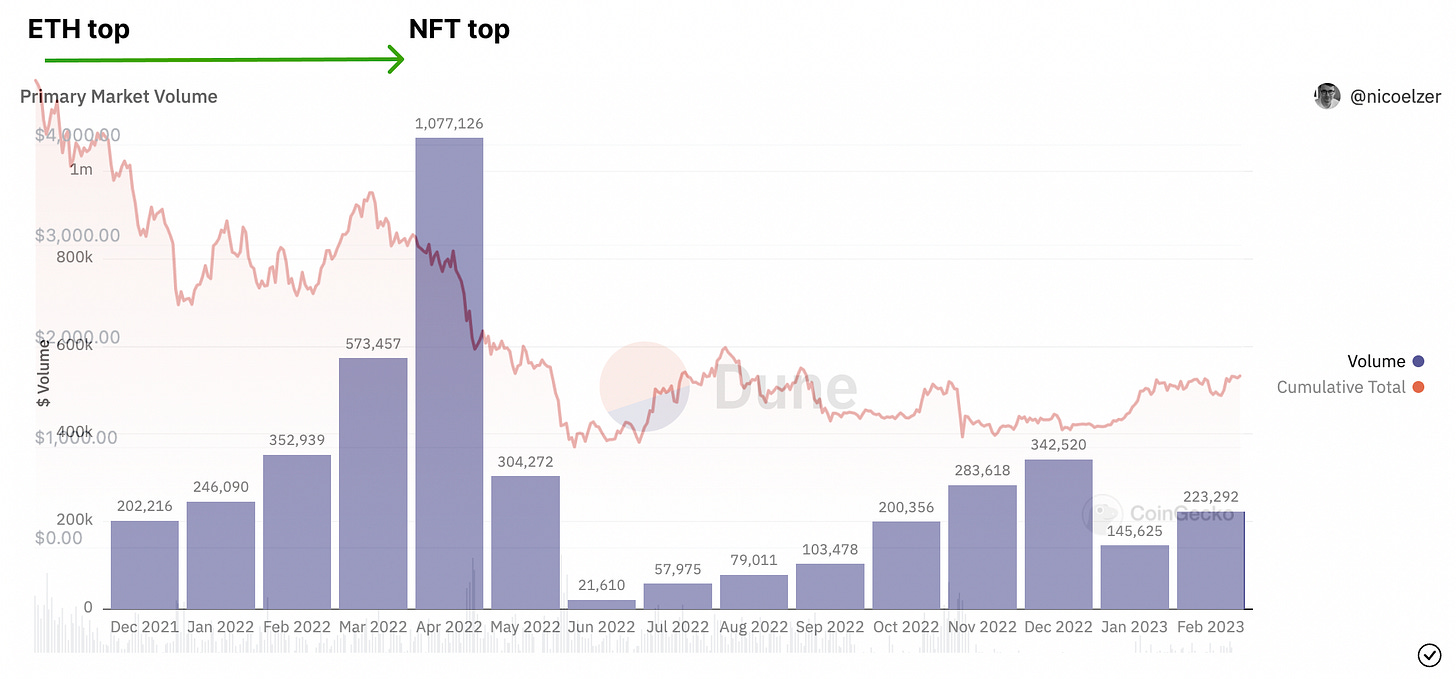

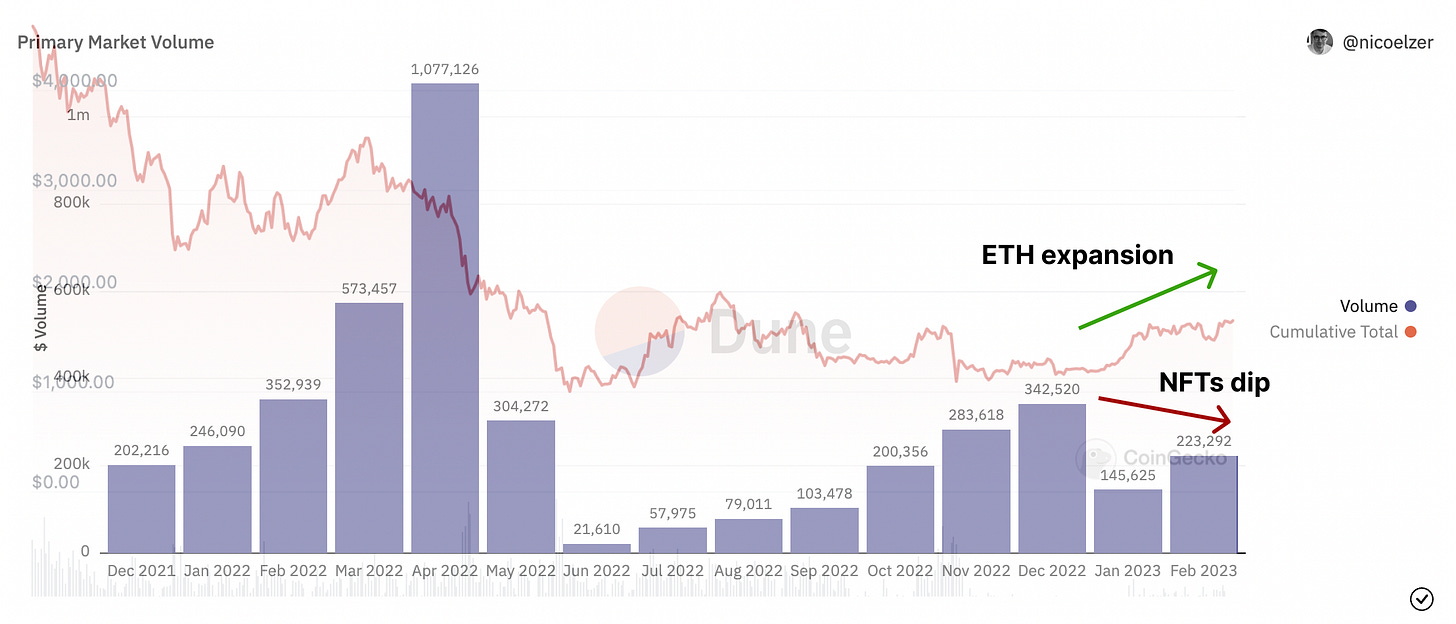

The chart above shows the ETH price laid over music NFT sales data.

You can see how music NFT sales fluctuate according to the broader crypto markets and the price of ETH.

The tl;dr:

Euphoria - NFT sales up (on a lag) 🟢

Panic - NFT sales down a lot 🔻

Flat / accumulation - NFT sales up 🟢

Expansion - NFT sales down a bit 🟠 *we are here*

Let’s dive deeper into it.

Music NFT sales are from Sound.xyz // Dune Analytics // Nico Elzer. This is not a full picture of music NFTs but it’s the best data we have and acts as a fairly accurate proxy for the rest of the market.

1. Euphoria 🟢

When crypto markets are euphoric the money flows into NFTs.

Collectors feel flush. People take profits in crypto and roll it into NFTs.

BUT this usually has a lagged effect.

BTC and ETH will often top out while the rest of crypto and NFTs peak a little later.

This is also where valuations can get crazy.

2. Panic 🔻

Moments of panic kill all markets!

Crypto prices and NFT prices collapse together.

e.g. the Luna disaster.

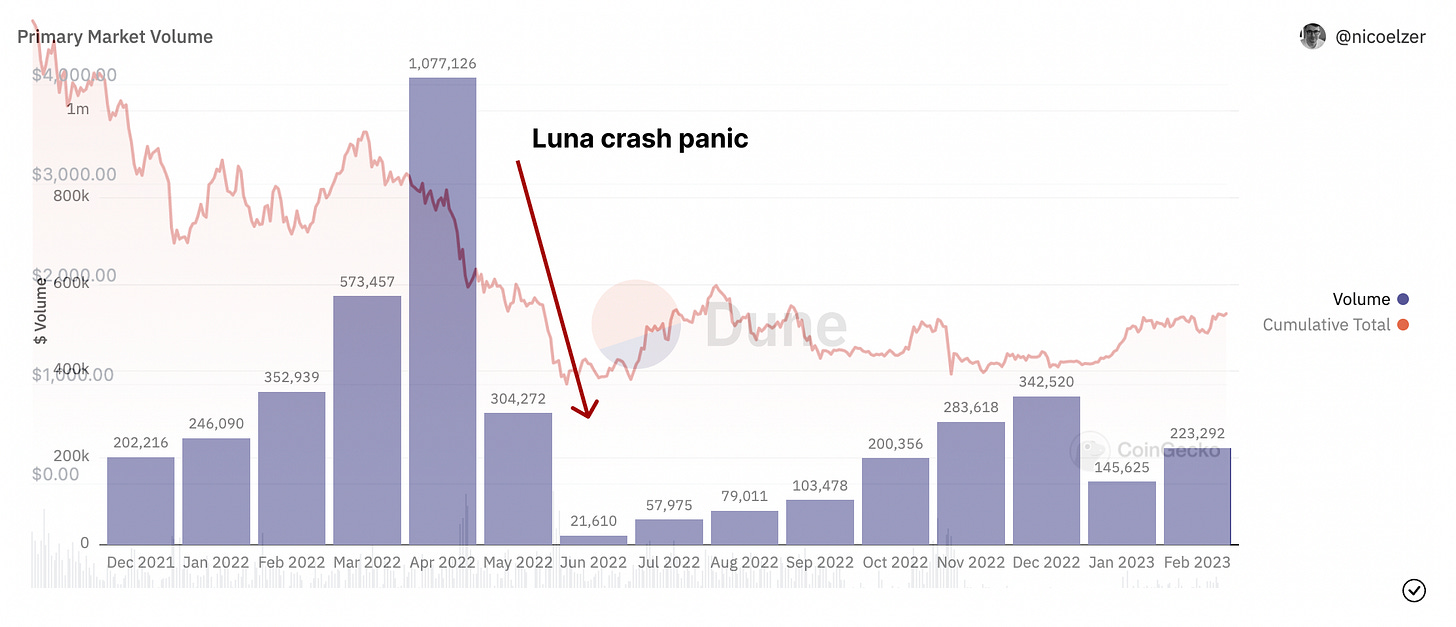

3. Flat / accumulation 🟢

NFTs thrive when ETH is stable and the crypto market goes sideways.

Collectors have readjusted to the steady price of ETH.

Volatility is flat so there’s less distraction. Attention can shift to NFTs again. It’s usually healthy, long-term buying from true believers.

You could see that happening between September - December for music NFTs. ETH completely flattened out and we had a mini bull run in Web3 music.

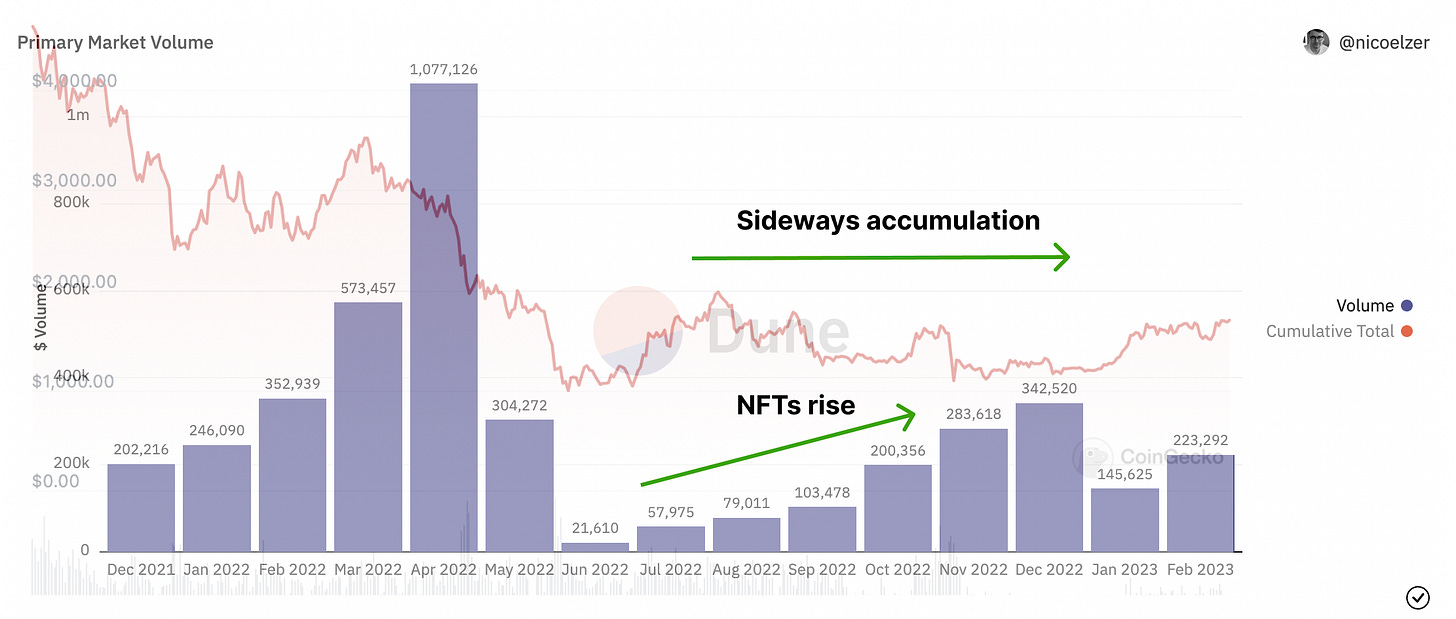

4. Expansion 🟠 ← we are here

Now, ETH is rising again. The price is up 40% since the start of the year.

It’s tricky to sell NFTs while crypto is moving like this.

People want to hold onto ETH because … it’s going up!

NFT sales often dip during rapid increases and we’re seeing that playing out in music NFTs.

[Although February looks stronger, note that Snoop Dogg’s open edition generated about a third of all volume which I think is probably an outlier]

During these expansion periods, NFTs are an ‘opportunity cost’ for collectors.

Many collectors are crypto veterans. They can find better ‘opportunity’ in other other parts of the market right now. They’re busy capturing gains elsewhere while the market it’s rising.

This is a good thing.

They’ll be back to the music scene with reloaded wallets.

This happens across all NFT markets

My example is music, but the same thing happens across the broader NFT spectrum.

NFTs do best during sideways crypto markets or a steady, trending ETH price.

Should you change your pricing?

The sharp rise in ETH also changes the psychology of pricing.

0.04 ETH for a music NFT in November was $44.

Now 0.04 ETH is $70.

As an artist, you don’t *have* to change your pricing, but price points that sold out in November are no longer selling very well (unless you’re one of the established artists).

Part 2. Identifying ‘tops’ in the cycle

Big, hyped-up events often mark the ‘top’ of momentum for crypto and NFTs.

Examples of event-driven tops in crypto include:

Coinbase IPO (macro top of crypto)

Bitcoin futures ETF launched (echo bubble top)

Other recent examples include:

The Ethereum merge (recent local top)

BAYC Otherside drop (macro NFT top)

These tops are obvious in hindsight but incredibly difficult to spot in real time.

I have a hard time getting it right in crypto but with music NFTs, I did have a feeling this would happen with the Daniel Allen x Reo Cragun drop in December.

It was extremely hype (with good reason!)

These events tend to attract all the attention, liquidity and create a peak of momentum.

You need something big to follow it up. Crypto is still driven by narratives so we need the next narrative.

We don’t have that yet.

But trust that it will come :)

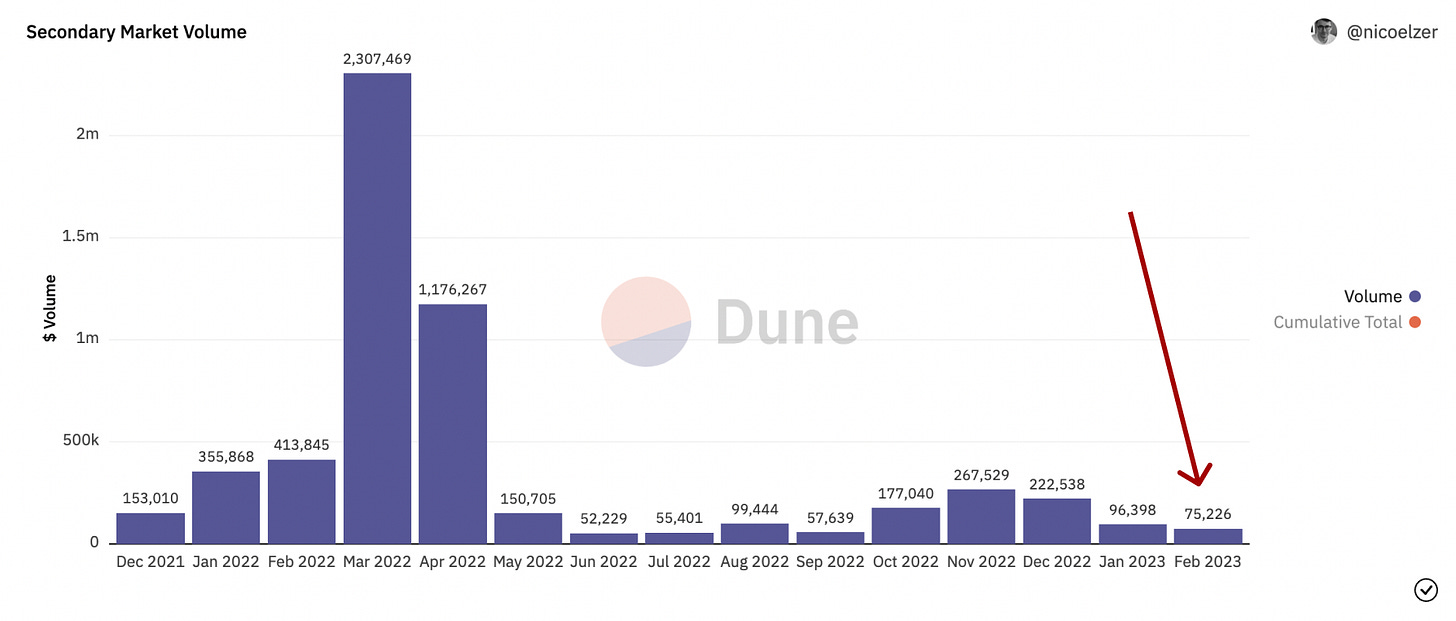

Part 3. The impact of open editions

We don’t have a whole lot of data on this, but the trend of open editions also seems to coincide with the short-term end of an NFT run.

For example in 2021, open editions marked the top of the art NFT cycle.

I don’t know exactly why, but my guess is that open editions can dry up the secondary market:

If everyone gets to mint the primary, there’s low demand for secondary sales.

The lack of scarcity means there’s less chance of flipping for profit.

People will get mad for me for saying this but secondary sales and flipping is healthy for the market.

It sets the balance of supply and demand.

Music just had its own open edition frenzy which might be why secondary volume has slowed down in February.

Collectors do need to sell occasionally in order to reinvest back into more music NFTs, and that requires a healthy secondary market.

How to adapt to crypto cycles?

There’s no ‘right’ advice for everyone.

Artists who trust in the value of their work should do what feels right for them regardless of market conditions.

But I’ll offer some suggestions of how I’m thinking about it.

Lower pricing - There are times to prioritise $$ and there are times to prioritise community. This can be a good time to focus on bringing more people into your world at lower price points.

Slow down the cadence - You don’t need to drop every week and be present 24/7 right now. Build towards a bigger project and wait to capitalize when the market flows back in your direction.

Rewards - There are times to give and times to take. In my opinion this could be a good time to give. Build loyalty for when the time is right to ask again.

You can’t force the market

You really can’t force the market to do what you want.

Be water.

Adapt with it.

Capitalise when the water is flowing in your direction.

Build and grow when it’s dry.

Thanks for reading!

If you found this useful, please forward it along or share in your group chats. See you next week.