Biggest ever guide to Solana (for creators).

gm music fans,

I’m working on giving this newsletter a big upgrade in the coming weeks, but in the meantime, I wanted to share something I’ve been going deep into over the last six months: Solana.

I’ve always been Ethereum aligned but it’s impossible to ignore a multi-chain future and the energy in the Solana ecosystem is pretty electric. So if you’re an artist or builder in this space, I highly recommend taking some time to explore.

Hope you enjoy this one and I’ll be back soon with a big upgrade.

The Solana Starter Pack … for creators and musicians

Contents:

This is a long post so I’ve broken it down into 8 parts.

Part 1: Coming back from the dead

Part 2: Solana’s speed, explained

Part 3: Enforced royalties and evolving NFTs?

Part 4: Major NFT collections (and artists) on Solana

Part 5: Music on Solana

Part 6: Buying, selling and creating NFTs on Solana

Part 7: Who to follow, and where to start

Part 8: The tradeoffs of Solana

If you find this useful, please consider subscribing. Every week we cover the intersection of crypto, music and creators. Grab a coffee and let’s get into it!

PART 1. Coming back from the dead

One thing I’ve learned in crypto:

When everyone says something is dead … you better go check it out.

Ethereum was declared “dead” in 2018 but those who stuck around and looked closer saw the signs of life. Blocks still ticking over, developers still building.

A few short years later, Ethereum was back at all-time highs with revolutionary new products and defi summer kicked off the new bull market.

Things can turn around fast.

Solana had its own moment of death in late 2022, collapsing 95% from all-time highs after the implosion of FTX.

Solana should be deader than dead…

By all accounts, Solana should have been deader than dead.

This wasn’t just a project that got too much hype and needed time to cool off.

It was fully blown out.

Solana was heavily linked to FTX where the now-jailed Sam Bankman Fried was among its most vocal backers.

As narratives go … it doesn’t get worse.

Even the biggest projects on Solana gave up and left the ecosystem. Famously the DeGods project announced its migration to Ethereum, at which point it seemed that NFTs on Solana were also … dead.

But I followed my rule: when everyone says something is dead, you better go check it out.

So last summer I found myself poking around the Solana ecosystem.

And I discovered a platform called Drip Haus with a whole new model for NFTs…

Drip Haus is a simple concept. You subscribe to creators and get NFTs airdropped to you free every week.

Only possible on Solana?

This sounds like a simple concept but it blew my mind.

At the time, gas costs were soaring on Ethereum due to people buying the $PEPE memecoin. In the music community we were paying $10-$20 in gas fees to collect a music NFT on Ethereum.

But I logged into Drip Haus on Solana, connected my wallet, and got an NFT airdropped to me, completely free.

How was this platform airdropping millions of NFTs while we were stuck spending $20 on gas over on ETH?

This is where it started to click for me.

I always knew Solana was optimised for speed, efficiency and low-cost transactions …

But I hadn’t realised that it makes completely new products possible.

The Solana community has a motto: “only possible on Solana” because there are NFT use-cases on Solana that simply aren’t possible on ETH or even its Layer 2s (yet).

Solana was not dead…

As I dug deeper, I also learned that the Solana community was, in fact, not dead.

A loyal group of builders still believed in the mission and stuck around. The community created a memecoin $BONK and deployed it to thousands of builders and creators to help them keep going through the darkest time.

It’s the type of war-spirit and community you don’t fade in crypto.

New apps and platform were popping up across NFTs and Defi.

Most importantly, all the loudest voices of the 2021 cycle shilling Solana were gone, while the project’s founder Anatoly was pragmatic, level-headed and respectful in debate.

There’s something here…

PART 2. Solana’s speed and design, explained…

In the simplest possible terms, Solana is designed to be faster and cheaper than Ethereum. It’s throughput is much higher:

Solana: 2,600 transactions per second.

Ethereum: 15 tps

Optimism: ~2,000 tps

And it costs $0.005 to send a transaction vs fluctuating prices across Ethereum and its layer 2s.

If you’ve used the Solana network, it feels faster, more efficient and more … Web2.

But there’s a lot to understand about why Solana is faster … and why.

This section gets technical but it’s worth understanding what makes Solana faster and the trade-offs it makes compared to Ethereum.

a. Origins in finance

Solana’s early vision was built around finance. Slow execution in traditional finance can be a huge problem. Traders have an edge if they can see price quotes before others — they can jump in and execute a trade before lagging information gets to other traders.

If you are situated closer to the information — or have access to superior equipment — you have an unfair advantage.

Solana’s founders envisioned a single source of truth through a lightning fast blockchain, enabling fairer markets. Everyone is equal in a world of hyper-fast distributed servers.

b. Not everyone can run a node, and that’s okay

In Ethereum, anyone can run a node at home using a $100 Raspberry Pi computer. It’s part of the decentralized ethos, ensuring the average person can be part of the network and verify the chain, but the trade-off is slower speeds at the base layer.

On the flip side, running a Solana validator has much higher requirements, and higher costs in hardware. Not everyone can afford to verify the chain but the trade-off is hyper-fast efficiency with a sufficient amount of decentralization. Still, there are currently over 1,600 validators live on Solana.

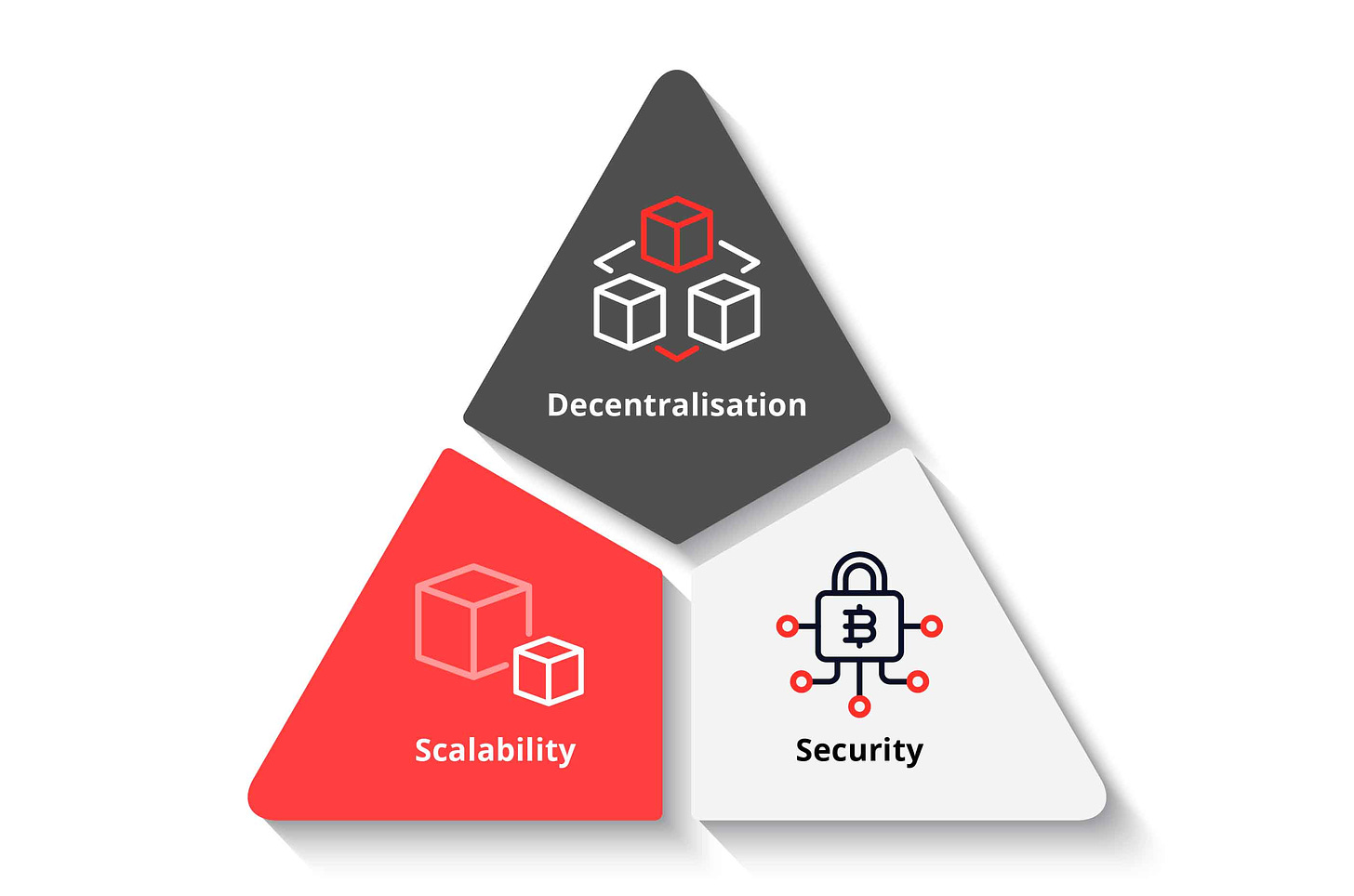

This is all part of the blockchain trilemma. Most blockchains can optimise for two out of three sides of the triangle above. Ethereum prioritized decentralization and security in the early days, and is now growing its scalability.

Meanwhile, Solana optimized for scalability from the outset and will improve its decentralization as it grows. Founder Anatoly believes that hardware costs will trend lower over time (following Moore’s law), enabling more and more people to run a node over time, allowing the network to progressively decentralize.

c. Modular vs monolithic

Ethereum is considered a “modular” design while Solana is “monolithic.”

You can think of Ethereum like lego bricks. The base layer of Ethereum mainnet sits at the bottom with dozens of modular bricks built on top to help it scale. You have layer 2s like Optimism and Arbitrum to help execute faster transactions, then you have data-availability layers like Celestia.

On the flip side, Solana is designed to do everything in one “monolithic” layer. No separate lego bricks, just one hyper-fast chain handling execution, data and everything else.

d. Eliminating congestion

Solana’s speed and efficiency also comes from how its blocks work.

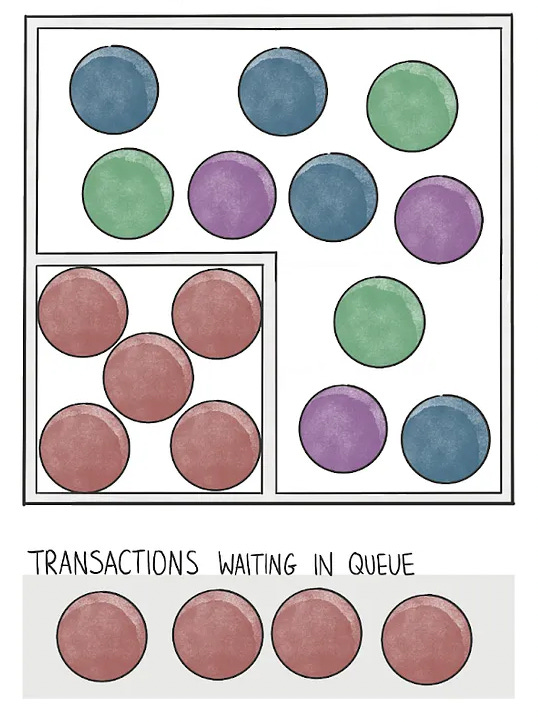

On Ethereum, you compete for blockspace across the whole network. If one project gets popular, it can drives fee higher across the board and slow down the whole chain.

We’ve seen this happen multiple times, from Crypto Kitties in 2017 to the $PEPE meme coin craze in 2023.

That’s because all transactions on the network are fighting to get into a block at once.

Solana is different.

Solana smart contracts are capped at taking up 25% of a block. So even if one app gets popular its transactions will never take up more than 25% of a block, leaving plenty of space to execute other transactions on the network without congestion.

If you’re interested in going deeper on the Solana tech stack, I highly recommend reading this piece by Decentralised.co. Probably the best deep dive out there.

A new world for NFTs

This speed and low-cost design sets up a new world for NFTs and consumer activity.

If Ethereum created the high-end, luxury galleries of scarce NFT art, Solana is the playground for abundant, day-to-day use of NFTs.

NFTs on Solana can be airdropped in batches of millions for very low cost. They can be dynamic and evolve. They can be a seamless part of games and brand loyalty points.

PART 3: Enforced royalties and evolving NFTs?

Solana also has a subset of NFT standards that give them more power and flexibility than currently exists on Ethereum.

Programmable NFTs - The pNFT standard allows creators to add programmable aspects into the token itself. You can program enforced royalties at the contract level or hard-code other rules into your project. (Read more at Delphi Digital).

Executable NFTs - xNFTs are NFTs that can execute code and turn into little apps. For example, Mad Lads are executable NFTs that can interact with staking platforms like Jito. (Read more at Delphi Digital).

Compressed NFTs - State compression enables Solana to shrink large amounts of NFT data. It stores only the essential data onchain so it can be verified; the rest is referenced off chain. It reduces costs MASSIVELY. You can mint 1 million NFTs for approximately $247. Doing the same on an Ethereum layer 2 would cost $98,000. (Read more at Magic Eden).

These extra layers of NFT tech is why Solana could be the home for things like in-game assets. They can be airdropped for almost no cost, they can evolve and act as XP points, while enforcing royalties within a game.

PART 4. Major NFT collections (and artists) on Solana

Claynosaurz - Claynosaurz is an animation studio built around cute dinosaur cartoons. You can think of them as the Pudgy Penguins of Solana — family-friendly, accessible IP, centred around short-form video. The collection of 10,000 aims to evolve into film, media and TV franchise.

MadLads - The biggest project by market capitalisation is Mad Lads. It was created by a former FTX developer who built a new Solana wallet and exchange called Backpack.

Tensorians - Tensorians is a collection of 10,000 pixelated characters created by the Tensor exchange. You could only mint if you owned a Tensorian Shard which you could only get as a Tensor user from Season 2. It’s also the first big collection to used compressed NFTs.

Qekz - 4,500 pixelated ducks.

Froganas - 5,555 frog pfps

Solana Native artists

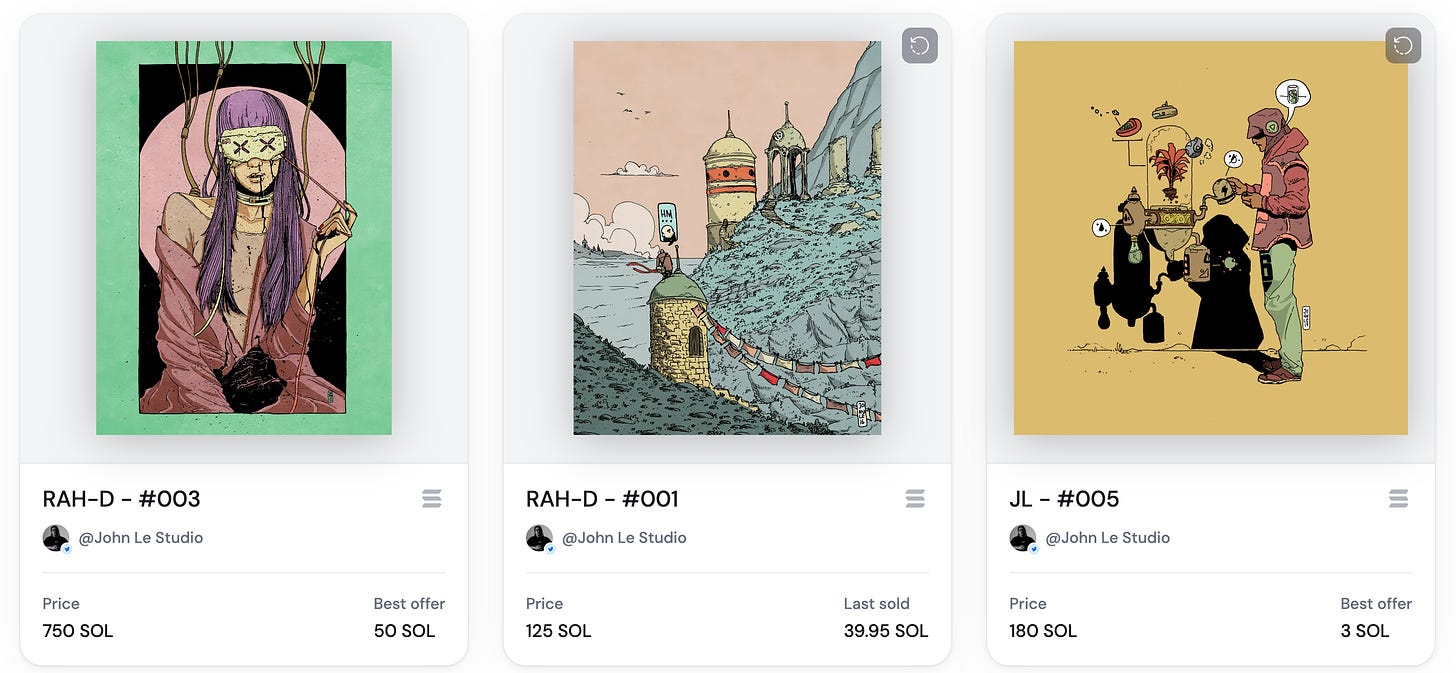

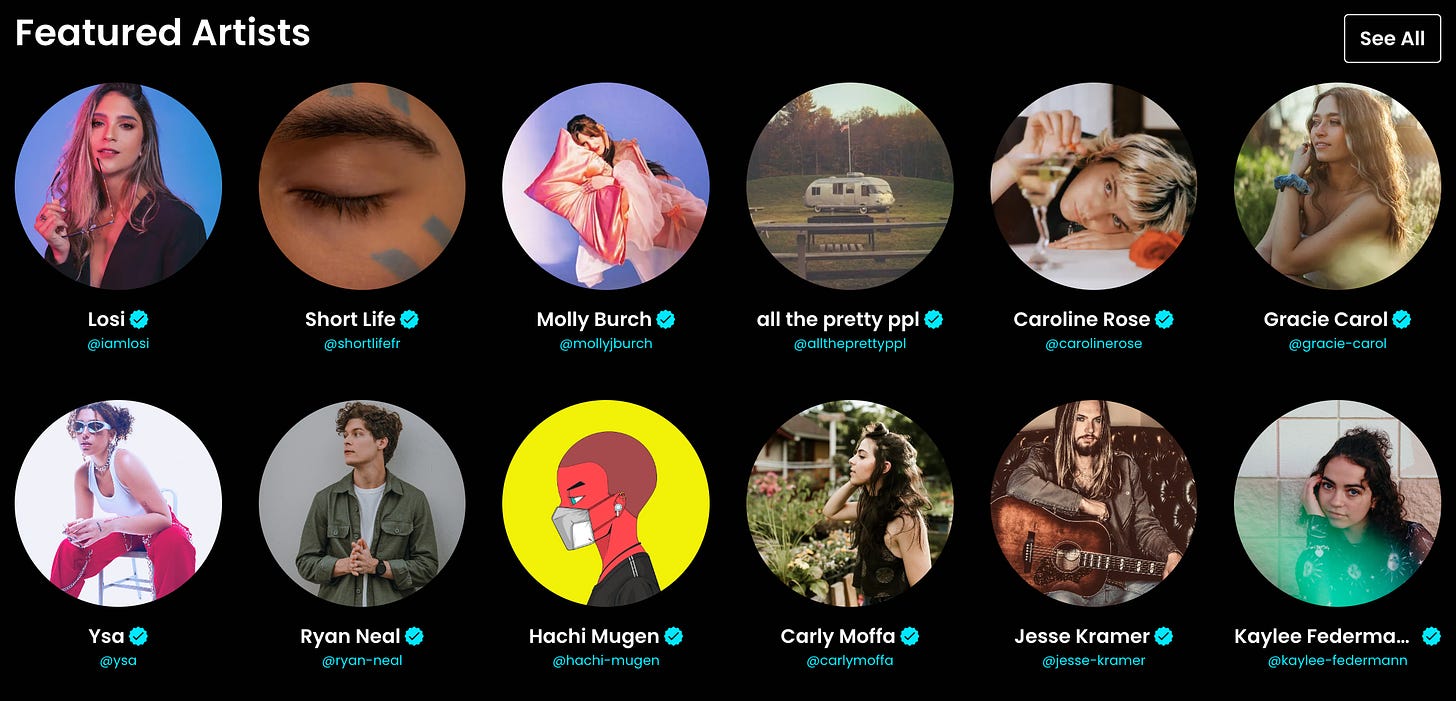

There’s a growing art scene on Solana based around Exchange.art. You can think of it like SuperRare but it also enables editions. Below are some of the top-selling artists on the platform.

Degen Poet - A “typewriter artist” with over $1.9 million in volume.

John Lê - The second-highest selling artist on Exchange with $1.4 million in volume.

PART 6: Music on Solana?

The music ecosystem is still early on Solana but there are small shoots of activity.

The Whales are a virtual band backed by Def Jam Records. The band is made up cartoon whale NFTs, released animated teasers on Drip Haus and recently launched a digital-first vinyl on Solana.

Nina is a music protocol and marketplace that’s been around for a few years. It’s not as developed as Sound and Catalog on Ethereum, but it still serves as a place to get your music onchain in the Solana ecosystem.

Vault is a music platform that allows you to buy and sell limited edition music. They also have a fantasy record label product and a presence on Drip Haus so you can subscribe and get free music collectibles.

Audius is a web3 streaming platform that taps into Solana.

PART 7: Buying, selling and creating NFTs on Solana

Magic Eden - Magic Eden was the dominant exchange on Solana until recently when it changed strategy and went multi-chain in 2022, adding support for Ethereum and Bitcoin Ordinals. They recently partnered with Yuga Labs to create a marketplace that enforces royalties.

Tensor - Tensor is the disruptor that ate a large chunk of Magic Eden’s market share in 2023. Rather than pivot to other chains, Tensor stayed loyal to Solana and launched a points system. It also created the Tensorians collection.

Exchange.art - The leading art marketplace, similar to SuperRare or Foundation on ETH.

Drip Haus - A platform for free collectibles. Subscribe to an artist, get their work airdropped weekly, and support them with micro-payment donations.

Where to create NFTs on Solana?

Metaplex is the leading place to create almost anything you want. Think of it like Manifold or Zora on Ethereum. Metaplex helped engineer many of the NFT token standards on Solana and they built a no-code Creator Studio so you can easily create what you want.

You can also create an artist account on Exchange.art to begin selling your artwork, or apply to Drip Haus to be a featured creator on their platform.

Wallets?

Phantom - One of the easiest wallets across all of crypto. Highly recommended place to start. Phantom will feel intuitive for anyone who’s already familiar with Coinbase Wallet or Metamask, and it’s not too daunting for new users.

Backpack - If you’re a power user, I’d check out Backpack. It has all the normal wallet functionality but it also has built-in exchange and it can interact with executable NFTs (xNFTs). This is the next level of what wallets look like across crypto in my opinion.

PART 8: Who to follow?

Anatoly Yakovenko - co-founder of Solana.

Austin Federa - head of strategy at Solana foundation

Chris Burniske - rational investor with good perspective on Solana’s place in crypto ecosystem.

Santiago Santos - another rational investor and host of Empire podcast

Mert - CEO of Helius Labs and host of light speed podcast.

Vibhu - founder of Drip Haus.

Solana Poet - artist

Armani Ferrante - founder Backpack wallet

Richard - founder of Tensor

… And where to start?

We covered a lot of ground in here, so where do you get started? We made a little quest for you so you can slowly explore the Solana ecosystem.

Beginner

Get a phantom wallet.

Add $10 of Sol to the wallet (via Coinbase).

Connect to Drip Haus and subscribe to a creator.

Go to Exchange.art and look through the latest art drops.

Go to Tensor and scroll through the bigger NFT collections.

Intermediate

Create an NFT on Metaplex.

Get a Backpack wallet.

Buy and sell on Tensor.

Apply to be a creator on Drip or list your work on Exchange.art

Stake Sol on Jito.

Expert

Stake your NFTs via Backpack wallet on Tensor.

PART 9: The tradeoffs of Solana?

Of course, we should discuss the downsides and trade-offs that come with creating and collecting on Solana.

Minting creative works onchain should have a permanence. That’s the whole point, right? We’ve been rugged by so many platforms in web2 that remove our content, gatekeep our audience and change the rules.

Putting art or culture onchain should be immutable, forever. That’s the choice you’re making when you choose a blockchain.

Will Solana still be around and culturally relevant in ten, twenty years to preserve your work onchain? I’m at the point where I believe it will. It survived the last two years and came back stronger - the sign I was looking for to go deep.

However, Ethereum still has the longer history and bigger Lindy effect (a better chance of survival because it has already survived longer and built such a strong community).

Some high-end collectors prefer the permanence, security and Lindy effect of Ethereum, and they’re willing to pay higher prices and higher gas fees to secure it. I think ultimately this is a small number of collectors, especially compared to the millions or billions of people that Solana may reach one day, but it’s something to bear in mind.

Final Thoughts

Ethereum laid the groundwork with high-end, valuable, luxury NFTs built around scarcity. While this will always be relevant, the future of NFTs will be abundance. Everyone will own digital items to some degree, whether it’s through gaming, music, artwork or loyalty points.

That future requires a level of speed, accessibility and flexibility. Much of that will take place on Ethereum Layer 2s as we’re already seeing across Optimism, Arbitrum and Polygon.

But it’s also going to happen on high-performance chains like Solana.

A multi-chain future is inevitable — the market and activity is already telling us this. Creators should utilize whichever chain helps them achieve their goals and resonates with their vision.

After all, these are just tools for you to use. Go and explore!