Hey music fans,

It’s been a while. I started this newsletter because I thought music NFTs and “web3” was our best chance to meaningfully change the music industry.

I still do …

But we’re in a quiet period of change and consolidation. It feels like the time is right to check back in and see what opportunities are still out there.

Is “Web3 music” still a thing?

The promise of music and crypto was huge.

We were going to fix music royalties. Make payments to artists without middle-men. Give artists control of their data.

Maybe we could even unlock the true value of music and get artists paid.

We got close … but it didn’t really happen.

The 2021 hype-wave brought enormous venture capital injections. We traded millions in NFTs. Every major label was spinning up a web3 department. Billboard Magazine was tracking NFT sales and considering it for chart inclusion.

It almost changed everything.

But four years later, it’s a very different picture. The hype has gone and the money has dried up.

So what’s left? Time for a vibe-check. Who’s still here? Who pivoted? And is there still opportunity in music and crypto?

Let’s get into it.

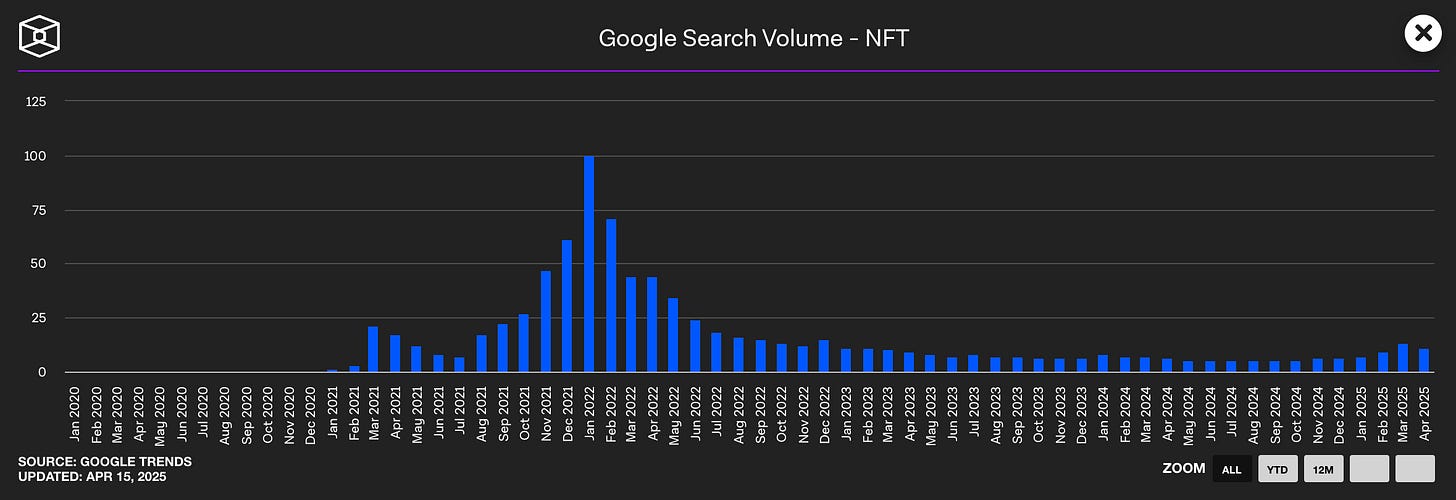

We’ll start with a broad sentiment check on crypto, web3 and NFTs.

Sentiment Check

Although crypto natives are still around, the public attention around NFTs peaked in January 2022 and never recovered. Sales volume hit a record high around the same point (May 2022).

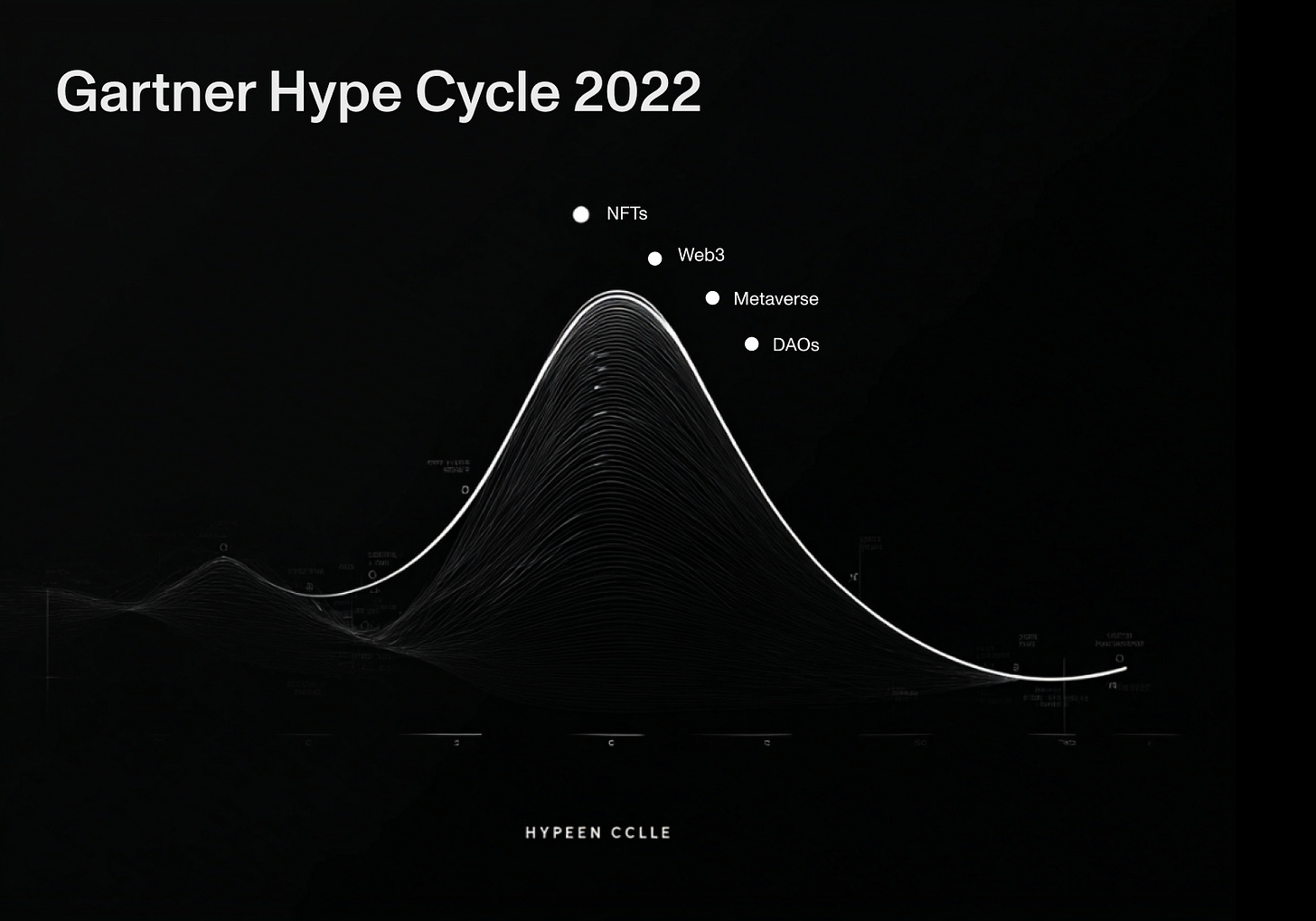

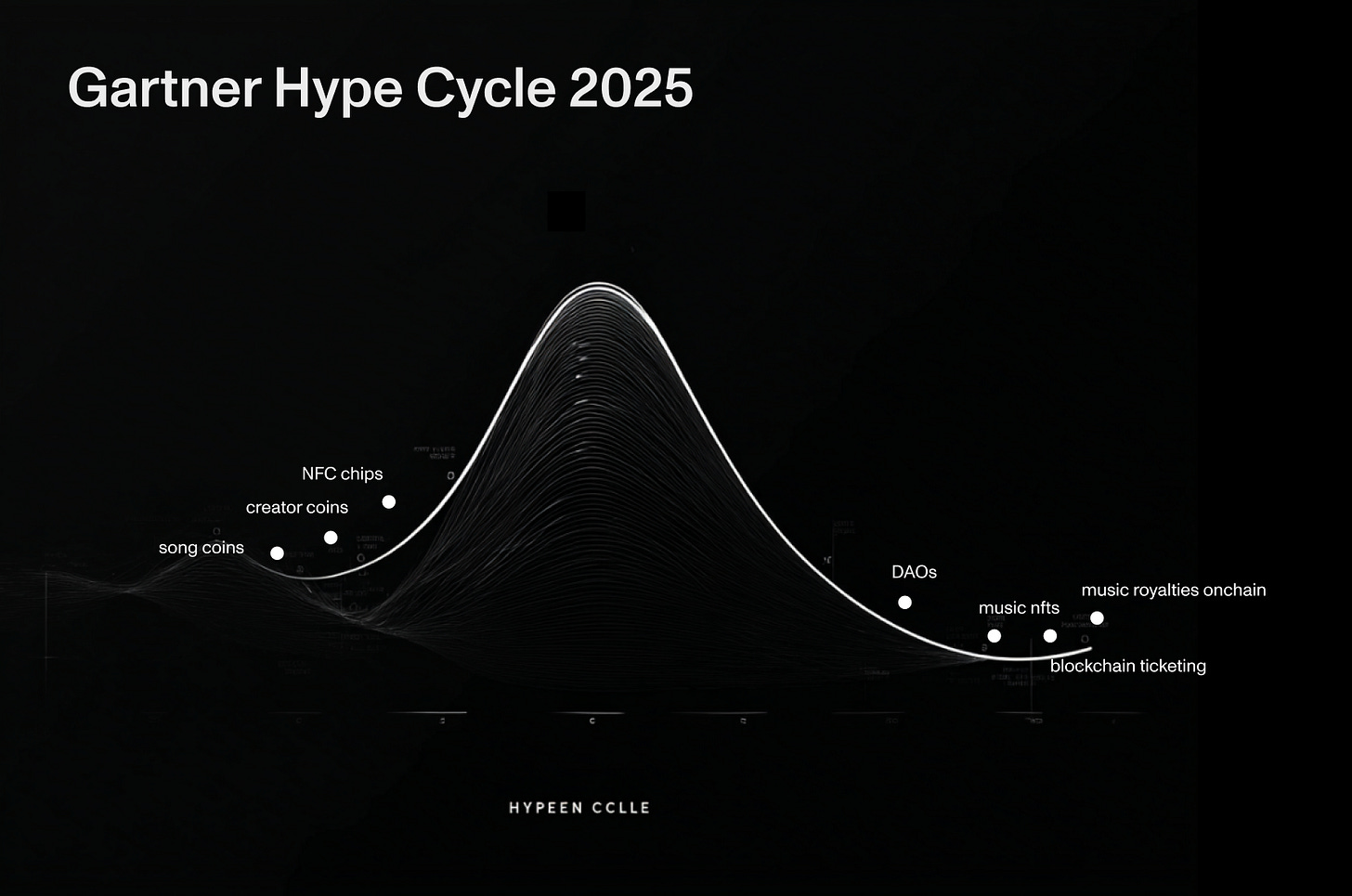

It’s the textbook example of the Gartner Hype Cycle.

We hit peak expectations at the start of 2022 when half the world was locked in their homes and terminally online, convinced that digital items and the metaverse was our new reality.

But then, two things happened.

The world went back to normal (sort of).

Crypto + financial markets collapsed due to interest rate hiking cycle.

The perceived value of “digital goods” dropped as we went back into the real world. And the crypto-rich who splurged on NFTs as status symbols no longer felt wealthy, as markets dropped. The money stopped flowing into the ecosystem.

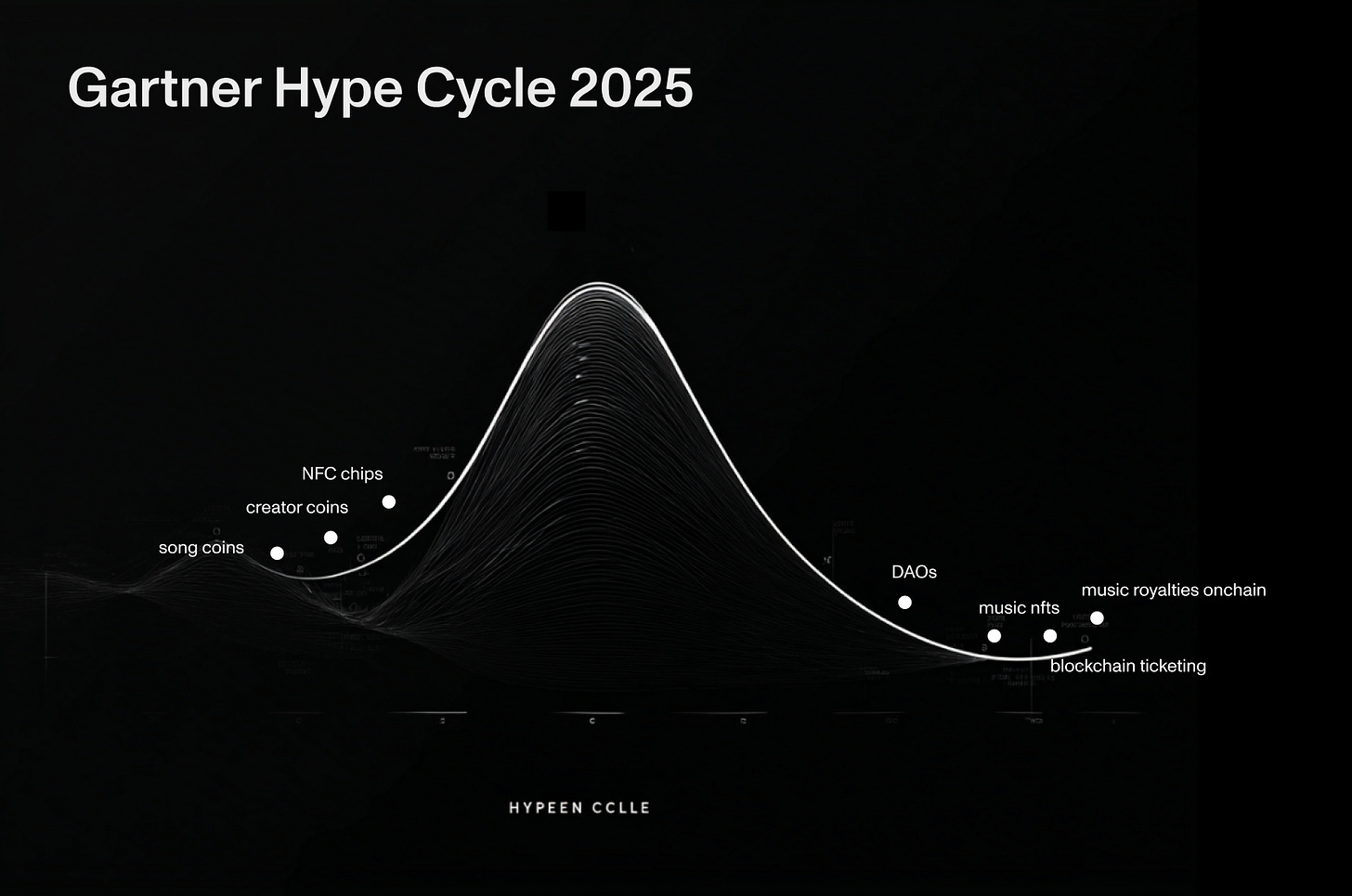

Fast forward to 2025 and all that promising technology is firmly in the “trough of disillusionment.”

A massive opportunity or never coming back?

If you’re in music right now, you could view this as an opportunity. Investing time or money during the disillusionment stage for new technologies can be extremely rewarding.

But it’s risky.

There’s always the chance that some technologies never recover from the trough.

To help you decide, let’s take a deeper look at what the music x crypto landscape looks like right now.

Who’s still active? Who’s not? And where are the innovators focusing on now?

Music x Crypto: Where are we at?

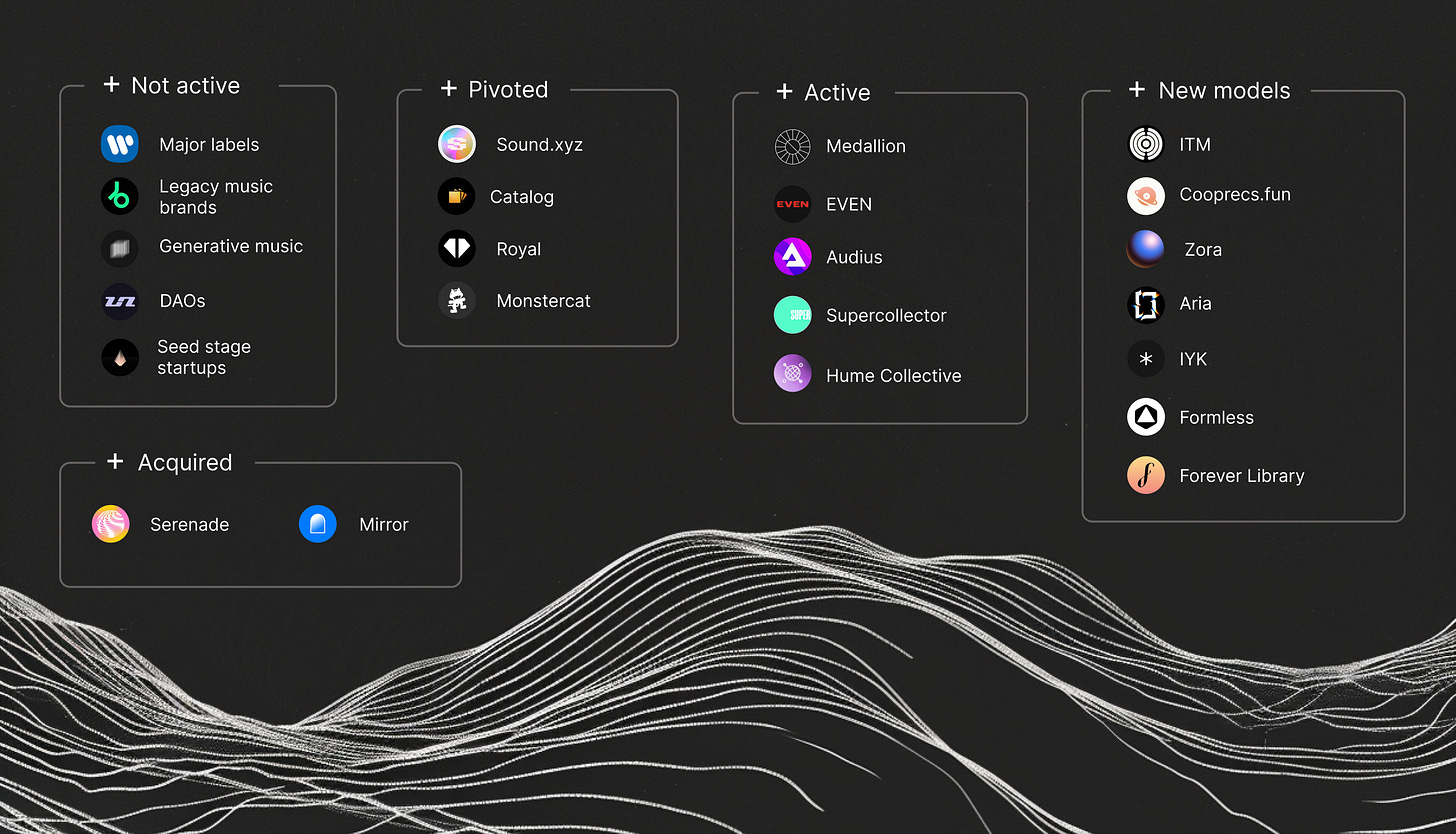

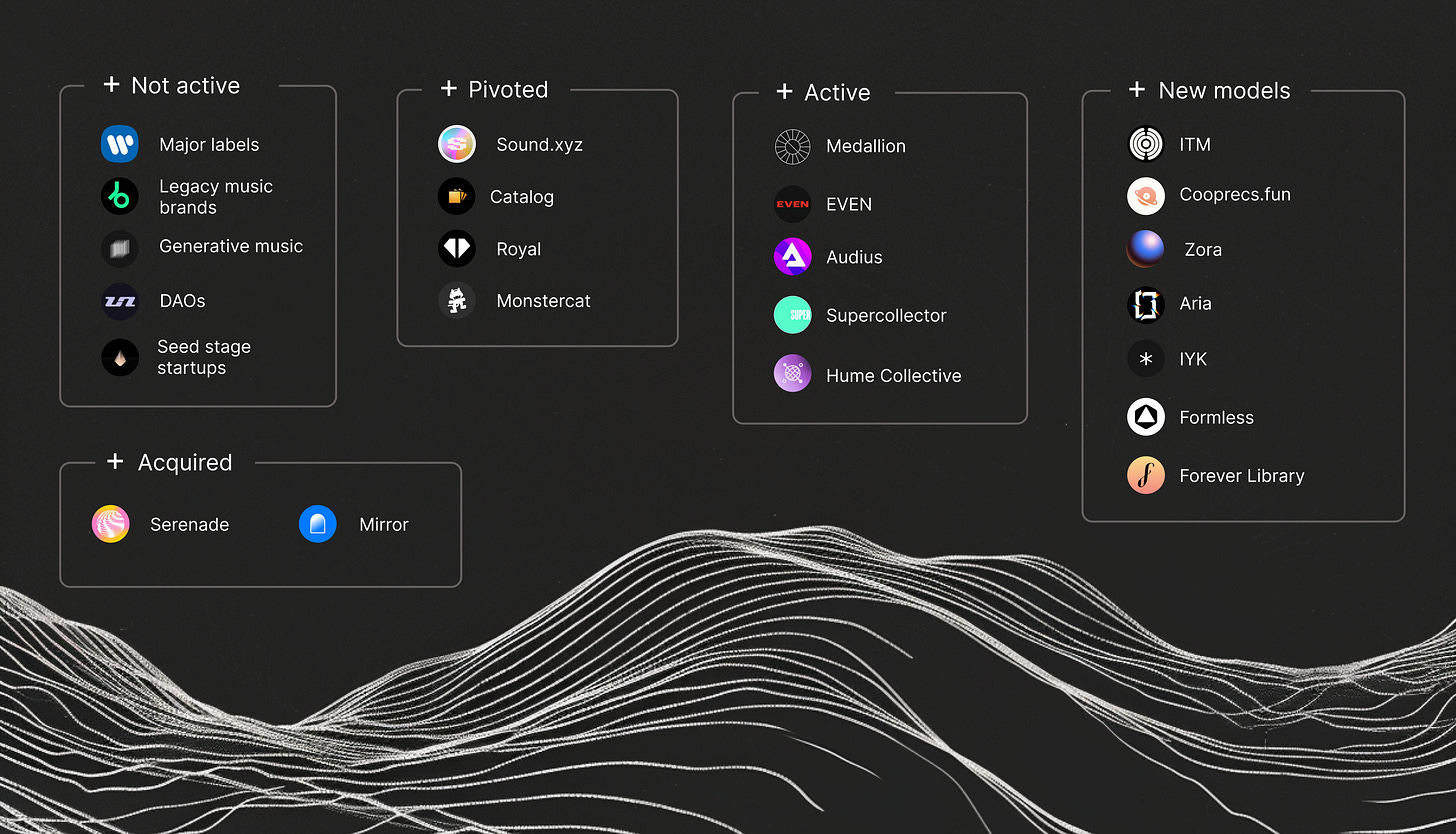

Part 1: No longer active

Major labels and legacy music companies are no longer active in the space. There was a time when Warner Music launched a web3 label. Universal signed a Bored Ape supergroup. Beatport hosted drops by Disclosure, and Limewire was acquired by tech bros who promised to resurrect it with music nfts.

Music DAOs and seed-stage companies. Community-owned record labels and music DAOs were among the most exciting prospects of web3, but most are no longer active. Meanwhile, dozens of seed-stage companies that raised capital during 2021-22 around the creator economy have reached the end of their runway and unable to raise further capital.

Part 2: Pivoted

Lots of companies built a business model around “collecting” music but have since pivoted to focus on other tech or music problems.

Sound.xyz - The biggest music NFT platform with $7 million in sales entered maintenance mode in May 2025. The team shifted its focus to Vault — the direct-to-fan platform launched in partnership with James Blake.

Catalog - The original 1/1 music NFT site has turned to a Bandcamp-esque direct-to-fan sales platform, using crypto rails for payments.

Music royalty platforms - Royal gained traction for attaching music royalty streams to NFTs from artists like Diplo and Chainsmokers, but uncertainty around US regulations put a hold on this model. Royal since pivoted to an AI music attribution platform, and now plans new products for 2025.

Part 3: First-wave Web3 Platforms still active

These startups gained traction or funding through crypto and are still active with the same or similar model.

Audius - decentralized music streaming

EVEN / Supercollector - direct-to-fan music sales, using crypto payment rails.

Hume Collective - Virtual artist record label

Medallion - digital fan clubs.

Part 4: Acquired

A small number of companies that gained traction from the NFT wave were able to exit through acquisition.

Serenade - Serenade was the first to establish “chart-eligible” NFT albums in the UK — helping Muse reach number one in the official UK charts. The platform was acquired by Vinyl Group in 2024 in a $2 million deal.

Mirror - A web3 blogging platform popular among music creatives was acquired by a competitor Paragraph.

Part 5: New models

These startups represent newer entrants or those that have established net-new models using crypto rails in the last 18 months.

1. ITM Studio (Events infrastructure)

FKA Twigs and SZA used ITM to sell tickets for their album launch parties. ITM uses blockchain for transparent data so the artist can track fans at every purchase point, and build a more holistic view of who is interacting with them across events, merch and other touch points.

Why this is innovative: It meets fans where they are, without burdening them with crypto payment complications. It uses the underlying tech to give artists more control over their data.

2. Coop Records

After years of exploring the music NFT model, Coop Records is shifting its focus to “songcoins” — liquid, tradable coins for every song. For example, NOTION’s “Days” remix is a tradable coin with $150,000 market cap. Coop Records is working with large independents like Ninja Tune and BitBird.

Why this is innovative: Coins are much more liquid than NFTs — meaning there is always a pool to enable buying and selling. With a liquid market attached to a song, music can potentially be valued by the free market based on its real world traction.

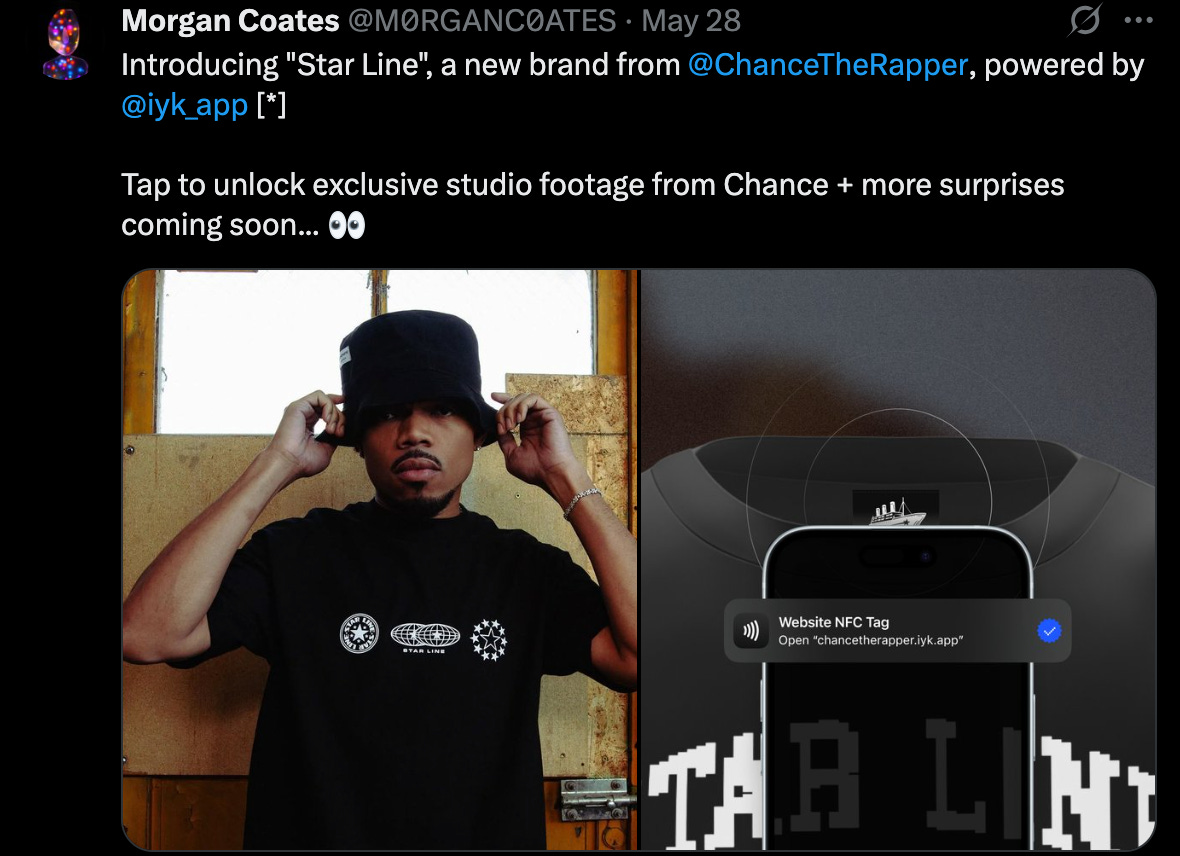

3. IYK

Digital x Physical products. Chance the Rapper’s new clothing collection uses scannable NFC chips from IYK that unlock studio footage and exclusives.

Why this is innovative: It ties into existing fan behaviour (buying merch), while adding surprise and delight of exclusive content. It feels like future-tech without the baggage of crypto.

4. Aria

A music royalties startup that acquired partial rights to 48 songs including tracks by Justin Bieber and Miley Cyrus. The rights are tokenised, then used to back a single tradable token $APL.

Why this is innovative: Putting music royalties onchain is not new (Royal + Anotherblock) but Aria is betting that clear US regulations are coming from the new administration so it can push the envelope on tokenizing music royalties.

5. Forever Library

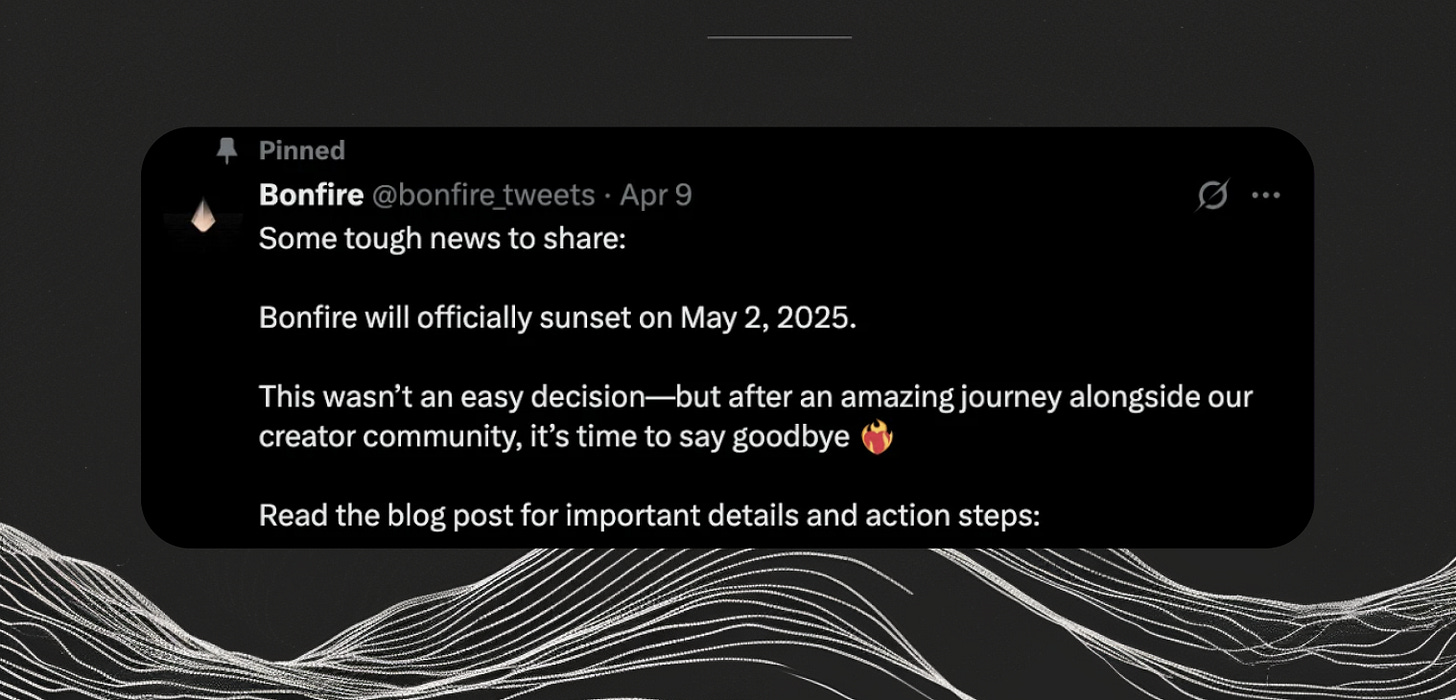

Forever Library is a response to NFT platforms shutting down or pivoting, leaving artists without tools or support for their drops. It’s a “public goods” minting contract (not venture backed) that cannot be changed so it can’t pivot or be shut down.

Why this is innovative: As we’ve seen, dozens of minting platforms have changed their features and contracts or shut down completely. Forever Library will protect against this by giving artists permanent reliability.

6. Formless

Formless is a new micropayment model where fans can promote a song, then receive a revenue share.

Why this is innovative: It lets fans share in the value they create by promoting the songs (it’s like incentivizing your street team). Crypto is used for a very practical use case that can’t be achieved on tradition rails — micropayments and instant multiple revenue splits.

7. Zora

Originally a popular home for music video NFTs, Zora is now a slick mobile social app where every creator and their posts are represented by tradable coins. Like a crypto-powered Instagram.

Why this is innovative: It gives fans a chance to capture upside in their favorite creators or bet on content they think will gain attention. It also introduces a new concept of ranking social feeds by free market forces.

Which path: Free markets or invisible crypto?

There are two paths emerging in these next-gen projects: “free markets” or “invisible crypto.”

Startups like ITM, IYK and Medallion are betting on invisible crypto. They are meeting fans where they are (events, merch and fan clubs) and using crypto under the hood for improved data, payments and efficiency.

a. Invisible crypto under the hood

ITM co-founder Saarim explains his invisible crypto approach: “Today, artists are media brands. But the brands are built on siloed, rented platforms (eg. Spotify, Instagram, TikTok). As a result, they struggle with having to continuously repurchase access to their own audiences. ITM flips that model by anchoring fan identities and engagement onchain, so artists can collect, retarget, and reward supporters directly while new experiences can be built on top of the data permissionlessly from day one.”

b. Crypto free markets

Meanwhile, platforms like CoopRecs, Zora, Aria and Formless lean into crypto free markets. They’re focused on unlocking value and letting financial incentives form the product.

Coop Records founder Cooper Turley explains: “Our next chapter is doubling down on coins as a means of valuing music and finding novel ways to allows fans to earn for consuming and interacting with the songs on our site. Cooprecords.xyz is an end-to-end product and our current sights are on pushing out a mobile version in the app store so that anyone can use it with no prior knowledge of crypto.”

Both of these approaches tap into crypto super-powers, but both have challenges.

The free-market products will immediately find an audience with crypto-natives who love to experiment, but face a challenge to convert skeptical music fans who are generally not receptive to crypto.

On the flip-side, “invisible crypto” products have a difficult cold-start problem because they simply have to be better than every web2 product that already exists and take away market share from an entrenched industry (a hard task).

Will there be a comeback?

We are in completely unknown territory right now. Companies that found traction through hype in 2022 now need to climb out of the trough of disillusionment and find sustainability.

New trends on the left side of the curve need to find the initial spark and attract new users.

Where do we go from here? I don’t know the answer, but I look at this chart and see opportunity for artists and entrepreneurs that are willing to build with conviction and belief.

There are no clear winners yet and the playing field is wide open.

Actions: How to experiment in web3 in 2025

For artists

Post some social content on Zora. It’s a good exercise in seeing what “web3” feels like in 2025 with low-stakes.

Continue to upload songs to music nft platforms like Catalog. There’s little downside in having your music available in multiple places.

For labels and managers

Check out ITM for hosting events and see how it feels to start owning data across different touch points.

Experiment with IYK chips as part of your merch strategy.

For music fans

Check out Coop Recs for collecting and trading songs.

Browse Catalog and Super Collector for music to buy and collect.

Thanks for reading! I’m aiming to publish weekly maps on the future of music — tracking crypto, AI, culture and technology as it shapes the music industry. If you have any suggestions feel free to reply directly to this email!

You’re a real one - appreciate the insights here 🫡