Hey music fans,

Last week we talked about how Web3 music was stuck in the “Trough of Disillusionment.” Well, it got me thinking about where other technologies and trends are in the music hype cycle right now.

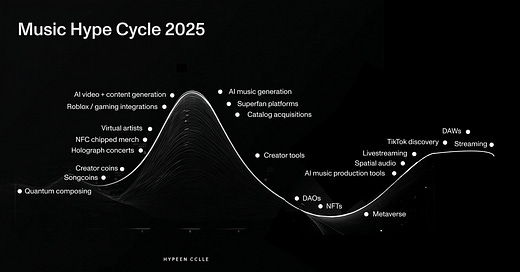

From AI to NFTs to streaming, we’ve mapped 20 music technologies onto the Gartner Hype Cycle chart using a combination of trend data, venture capital funding and … some intuition.

It’s a good way to spot opportunities if you’re:

An artist looking to capture rising trends.

An entrepreneur looking for pockets of disruption.

A music industry professional trying to navigate over-hyped trends.

At the end I’ll also give you my breakdown of how to capitalize on some of these.

Let’s jump into it.

What is the Gartner Hype Cycle?

It’s a simple graph that maps the hype of a new technology against its practical adoption.

Almost every new innovation goes through this same cycle.

Stage 1: Innovation Trigger

The birth of a new technology. Innovation starts out in quiet corners of the internet, and it takes several years to grow out of this stage — usually when an entrepreneur creates a commercial product around it.

Stage 2: Peak of inflated expectations

The classic hype bubble. Your social media timelines are dominated by hot-takes, threads and YouTube videos. Venture capital deals get frothy and oversubscribed. New products pop up every week and mainstream media declares that it will “change the world.”

Stage 3: Trough of Disillusionment

Inevitably, no technology can sustain Stage 2 levels of expectation. Headwinds kick in (regulation, costs, technical limitations), and an abundance of competitors flood into the marketplace. Even the best companies fall short of impossible expectations. Attention moves on to another new technology. Late entrants run out of money and conviction. Mainstream media declares the technology “dead.” Only the strongest survive through the trough of disillusionment.

Stage 4: Slope of Enlightenment

Seeds of real demand and sustainability start to appear. Realistic use-cases for the technology are developed and reasonable expectations return. Companies build real business models and revenue. Second and third order products appear to strengthen the ecosystem.

Stage 5: Plateau of productivity

The technology enters a mature stage with mainstream adoption and predictable business models. Products are broadly accepted and several competing companies vie for dominance.

So, how does this map to the music industry in July 2025?

Stage 1: Technology Triggers

Quantum + neural composing

We are at the very earliest stages of composing music with quantum computing, and neural brain transmission. Early quantum synthesizers are enabling completely new sounds. Key players: Moth Quantum.

Creator coins

A future where every artist is represented by a tradable coin? Some very early experiments are playing with this idea. Key players: Zora.

Songcoins

Extremely early attempt at turning songs into tradable liquid crypto tokens. Key player: Coop Records.

NFC chipped merchandise

Buy merchandise → scan a chip with your phone → unlock exclusive content. Several major artists are using this technology (Chance the Rapper, Disturbed) and modest venture capital activity. Key players: IYK, Chipped Social.

Virtual artists

Virtual artists have grabbed headlines, but haven’t fully exploded yet. Keep your eye on K-pop for a possible breakout. Key players: EMPIRE, HYBE, Hume Collective.

Holographic concerts

Holographic concerts had a moment in 2012 when Tupac returned in hologram form to play Coachella. Now we’re getting concerts scheduled for ABBA, Elvis and more. No hype yet, but the trend is growing.

Stage 2: Entering hype cycle

Digital Music in Roblox

I’ve been writing about this for a while — record labels like Monstercat (via its spin-off RELICS) are selling digital music items, skins and music licensing in Roblox, with huge success. I expect more labels and music companies to follow soon. Roblox now has 98 million DAUs and grows at 26% annually. Key players: RELICS

AI video tools

AI video is in a slower hype cycle compared to AI music generation and LLMs. However, several new AI video models launched recently which could send it into an exponential growth stage. Google’s Veo 3 and Midjourney’s new video model give artists fresh tools for music video generation. Directors are already using it for complete music videos. While Higgsfield AI’s new social model could trigger new social media video trends. Key players: Veo 3, Midjourney, Higgsfield.

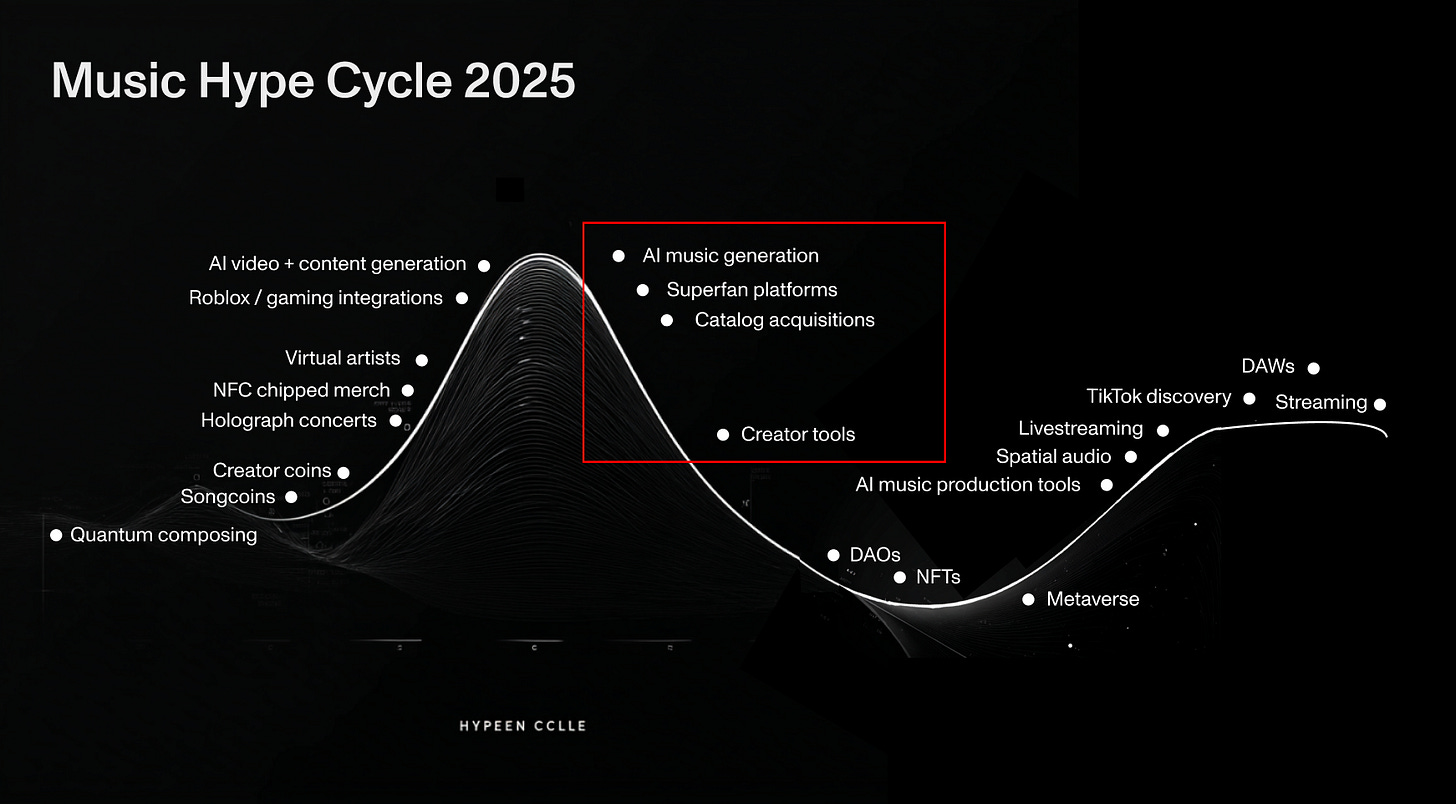

Stage 3: Peak of inflated expectations

AI music generation tools

We are now at peak hype for AI music creation. Mainstream media is publishing panicked headlines about the volume of AI-generated tracks on streaming services and major labels are racing to cut deals. However, we think the technology itself is now peaking in expectations. Innovation in new models has slowed and search trends for “AI music generator” appear to have topped out. Key players: Suno, UDIO

Superfan platforms

“Superfan” was the music industry’s biggest buzzword in 2024, leading to a frothy wave of venture capital and dozens of new apps and products. This year’s enormous $92 million investment in superfan platform DearU may have marked a local top for this trend, while the major labels and Spotify also scrambled to launched their own superfan initiatives. Despite the hype, reality isn’t tracking with the narrative. For example, only 3% of 13-44 year-olds purchased VIP music packages in 2023, and artists have shown limited appetite for managing a presence on multiple apps. Key players: Vaultfm, Mellowmanic, Sesh.

Catalog Acquisitions

Almost all the big private equity deals in music in 2024 were catalog acquisitions. Queens’s back catalog changed hands for $1.27 billion, while major financial firms like Blackstone, KKR and Apollo Global splurged $2.8 billion on music rights. This trend peaked as streaming hit record revenues with predictable yields. Expect these acquisitions to slow down as streaming growth slows.

Creator tools

We’ve seen an explosion of new music creativity tools (remote collaboration, virtual instruments, sampling tools etc.) These are now entering a period of consolidation with several mergers and buyouts this year. We’ll likely see more capitulation and acquisitions before the winners fully emerge in this category.

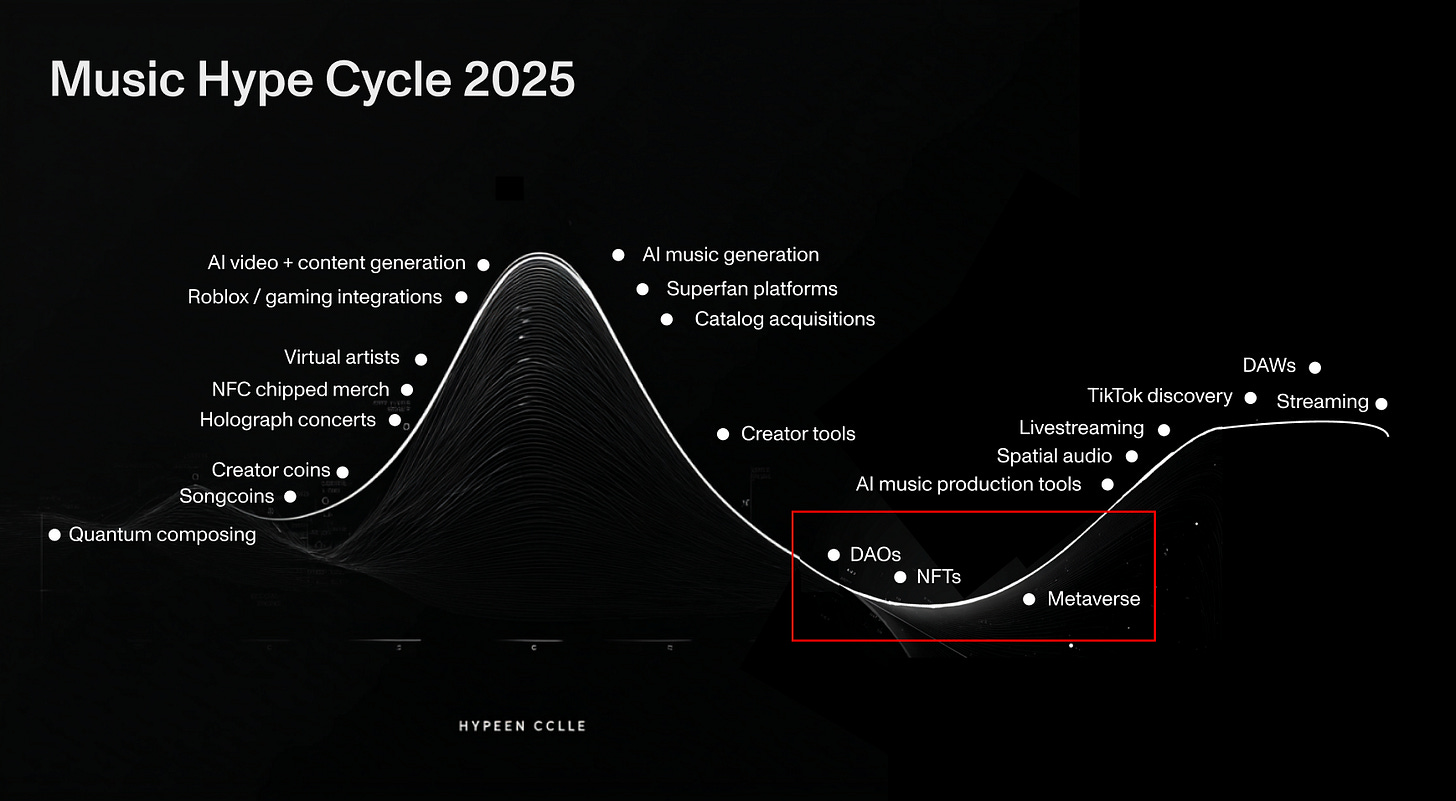

Stage 4: The Trough of Disillusionment

Web3 music, NFTs and DAOs

Hype around NFTs peaked in early 2022 and never recovered. Most of the leading music NFT platforms have shut down or pivoted their model, and sales are at almost zero. Mainstream media has declared NFTs dead. Other related projects like DAOs and blockchain ticketing have not materalized on a major scale. We wrote a longer report on this last week to identify opportunities — go check it out.

Metaverse concerts + VR

Expectations for the metaverse peaked in 2021 when 27 million people watched Travis Scott’s virtual performance in Fortnite, and Mark Zuckerberg changed his entire company to Meta. This future is probably still coming but our VR metaverse life is not here yet, despite the release of Apple’s Vision Pro headset since then.

Stage 5: Slope of Enlightenment

Spatial Audio

Apple kickstarted a hype trend for Spatial Audio in 2020 with the launch of its airbuds. 80% of GenZ say they’ll now pay extra for spatial audio headphones, and it’s becoming the default for streaming services and hardware devices. Last month Apple announced its new Apple Spatial Audio Format (ASAF), suggesting we are entering the mature stage for immersive music in digital environments.

AI music production tools

Producers are starting to embrace a world where AI is part of their daily workflow. Approximately 25% of producers now use AI tools for studio processes like separating stems, EQ or mastering. This is at the early stage of the maturation curve. Key players: LANDR, Moises

Livestreaming

Livestreaming through Twitch, YouTube Live and Instagram Live is now a stable part of album rollouts and artist promotion.

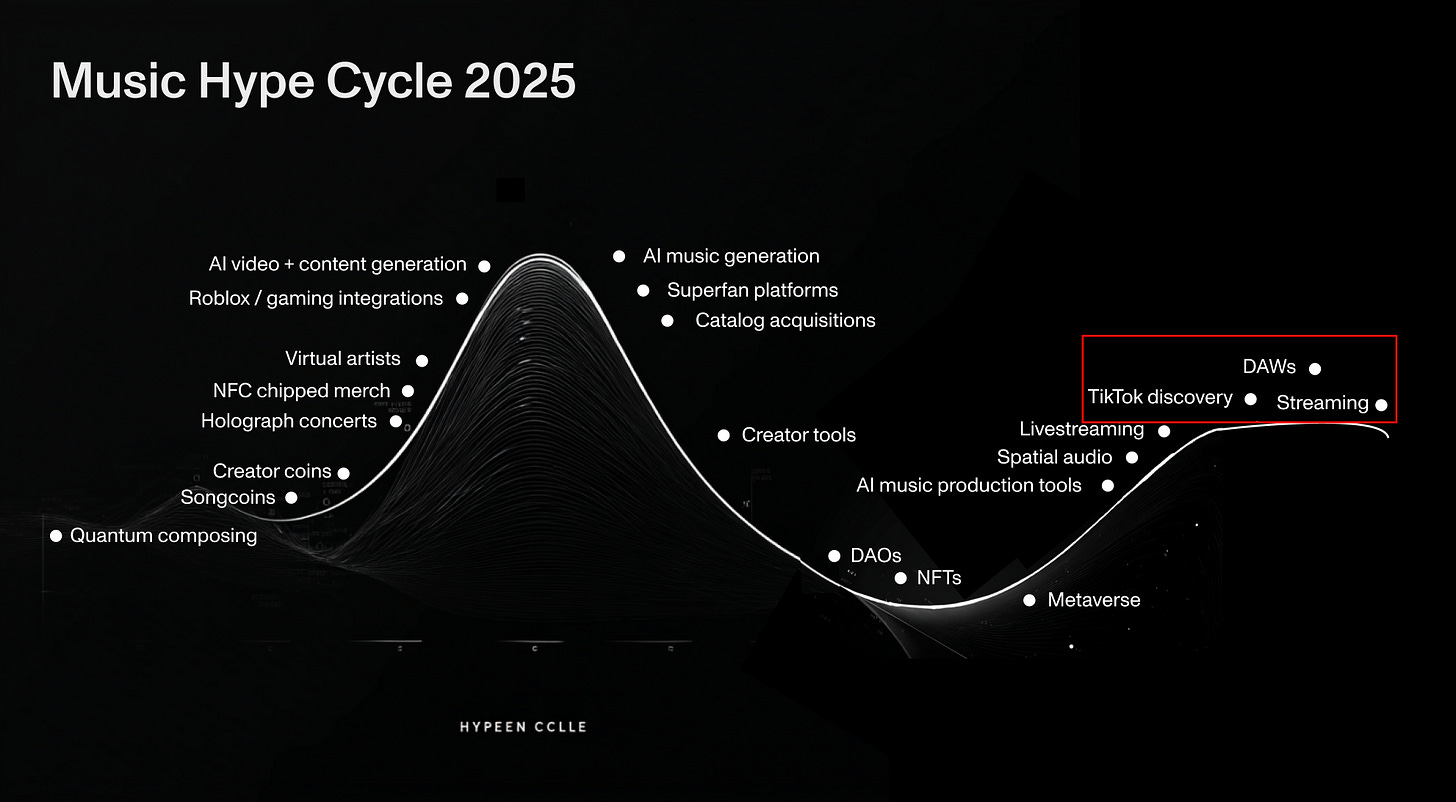

Stage 6: Plateau of Productivity

TikTok music discovery

~67% of fans now discover music on TikTok before anywhere else. The social app is now the most powerful machine for new music distribution. Short-form content is the dominant form of self-promotion and music rollouts.

DAWs

DAWs like Ableton are 10 years past their peak-attention moment and now firmly in a mature, steady, mainstream adoption stage. In 2024 the company consolidated its work force as growth tails off — suggesting it has now entered its plateau of productivity.

Streaming

Music streaming is now the entrenched dominant music model. It accounts for 69% of all recorded music revenues [IFPI]. Streaming is no longer in a hyper-growth stage, with growth rates now slowing as it reaches full saturation.

How to find opportunities?

There are opportunities at every stage of the hype cycle, and it fully depends on your personality and risk tolerance.

Big dreams - This is the opportunity to be the innovator and take a new technology from zero to one. You become the pioneer if it works, but it’s extremely high risk.

Short-term exponential - Opportunities are easy and abundant at the top of the hype cycle. You can achieve exponential growth if you participate … but keep in mind that it will not last long, and entering too late can be costly.

Conviction - There are opportunities at the bottom of the trough of disillusionment for those with high conviction, belief (and tolerance for pain). The winners that emerge on the other side of this become industry leaders.

Momentum - Engaging with a technology as it emerges from the trough of disillusionment gives you the chance to ride the momentum as it becomes mainstream. You may not be the leader, but you take less risk by waiting to see what emerges.

Disruption - The technologies in the plateau of productivity are usually reserved for the biggest companies so it’s hard to compete directly. However, these companies are now prime for disruption. The market is approaching saturation so look for opportunities to break habits and form new behaviors.

Thanks for reading!

Let me know if I missed anything or if you disagree with our placements on the hype curve? Hit reply to this email or reach out to me on Twitter. See you next week with another music industry map.

Thank you for your insightful email regarding the current state of music technology. I completely agree that AI music generation is currently over-hyped, and I share your excitement about how it will evolve in the future.